Copyright Vinsight Software

If you are involved with running the accounting side of a winery then you will know how tedious it can be to get an accurate cost of sales and also an accurate inventory valuations for end of month or end of year reporting.

Good accounting practice means that you try to align your expenses with the timing of the revenue that they relate to. In fact many countries enshrine this in their accounting laws such as the IRD in New Zealand and UNICAP requirements in the US that even require the capitalization of indirect costs such as : certain labor costs, employee benefits, storage costs, cost recovery (depreciation), rent, insurance, utilities, repairs and maintenance and the list goes on.

In a recent round of surveys that we did with winery accountants, the valuation of bulk and finished wine inventories was rated the most important and the most difficult task faced by wine businesses.

This was because, while it was fairly straight forward to allocate direct costs, the same could not be said of indirect costs or overheads. Many companies had no specials tools for this, and did these calculations only once a year at tax time, often after the wine had been sold. While is fairly easy to know what wine was produced, much of this work revolved around determining how to share out the costs accrued during the previous year. In the worst cases this was a flat average cost per bottle produced where they took total costs for the year and divided that by total annual production for the year. This gives a very blunt measure of the value of inventory which leads to inaccurate cost of sales for your differing products which means your gross profit margins on product lines are distorted and could lead to poor planning decisions and the financial implications of those.

Well we decided to give a little love back to accounting since it is helping keep us all in business. The winemakers seem to have a good handle on what wines they are producing and allocating direct costs, and the accounting team seem to have a good handle on the indirect costs of the business. What we needed to do was give the accountants a similar set of tools that the winemakers have but to be able to allocate overheads and other indirect costs to wines while in production and make this easy to do on a continuous basis.

New Feature: Overhead Allocator

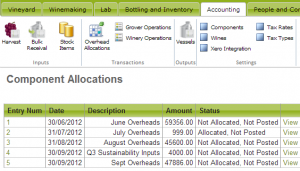

And with that: Vinsight now has a new feature the Component Allocator that allows you to allocate overheads. A simple tool that allows you to take your costs like wages, rent, R&M and utilities and with the click of a button allocate these costs to wines in the winery based on criteria of your choice.

You can setup simple rule sets like “red wine in barrels” or “white wines in tank” and set their share of the costs to receive.

So you get:

a process that is easy enough to do every month so you increase the fidelity of your allocations eg White wines that take 6 months to produce get 6 shares, while red wines that are aged and stored for 12 or more months get more.

a process that uses real time data (what wine is in the winery at month end) that is accurate and maintained by the winemaking team

a process that is documented in a system that is reusable by anyone you choose to share this with.