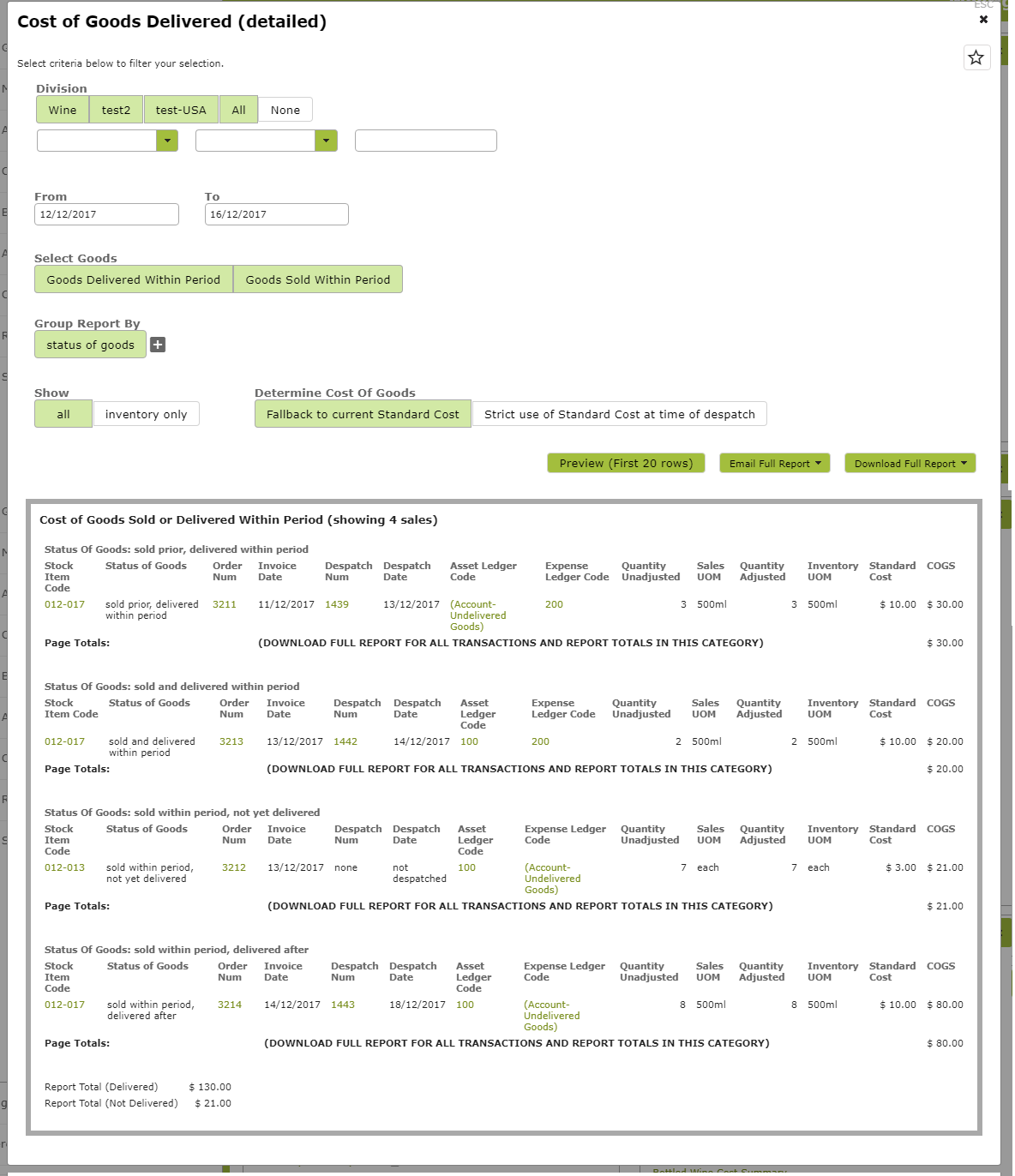

Our new Cost of Goods Delivered Report gives you more options when deciding how to journal your costs and inventory movements. Either ‘Cost of Goods Sold’ or ‘Cost of Goods Delivered’ are good options in terms of simplicity and you can select either option with our new report. However, while perfectly valid, they do have their limitations.

Choosing to journal your costs at the invoice date (‘Cost of Goods Sold’) will mean you are prematurely expensing undelivered items so your inventory levels at any one time could be understated. Choosing to use the date of despatch (‘Cost of Goods Delivered’) instead will better reflect current inventory levels but may involve reporting revenue and expenses in different periods resulting in your Profit and Loss Account being slightly skewed between periods.

A third option is to create a ‘Sold, Not Yet Delivered’ liability Account in addition to the Asset and Expense ledgers and to journal all sales and deliveries within the period to these three accounts. The sold but undelivered items can be journaled to this liability account and the undelivered liability of current deliveries, sold in the prior period, can be expensed to this account.

All options are available in our new Cost of Goods Delivered Report (on the Accounts Dashboard). Read more about each of these options here.