Vinsight’s cloud based inventory and sales app has just released a great new feature that helps you handle your Wine Equalisation Tax (WET) liability and avoid unnecessarily repeating your data entry along the way. It also helps you handle WET with Xero.

Create one invoice and use the data many times

Vinsight’s new WET Assessment feature allows you to enter data once, and reuse it to send ATO compliant invoices to your customers, record sales data, keep your inventory accurate, post it to Xero for use with your debtor management and workout your WET Liability to out on your Business Activity Statement. Wow that is a lot of use out of one piece of data entry!

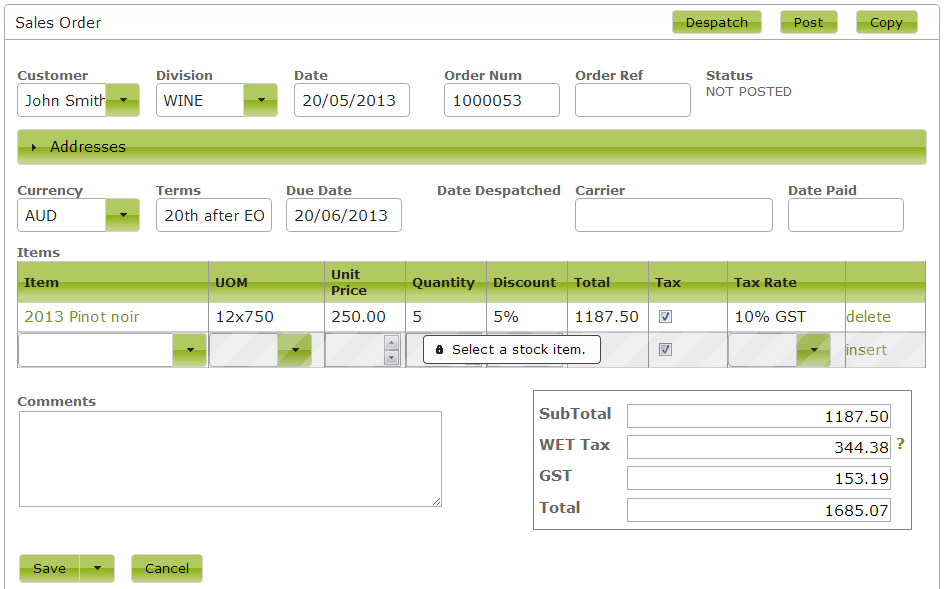

ATO compliant Tax Invoice showing WET Tax

When you enter invoices, Vinsight calculates WET Tax on wholesale invoices, and produces an ATO compliant Tax Invoice showing the WET Tax correctly and doesn’t rely on workarounds and kludges like pretend tax types like WEG. For non-wholesale invoices like, retail, these are assessed at the end of the tax period on Vinsight’s WET Assessment.

Also if you can’t understand why we have categorised the invoice this way. Then the little ‘?’ next to the WET Tax total pops up a helpful little window to explain what is going on.

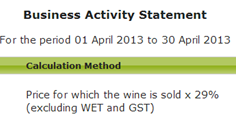

WET Tax Assessment to go on your BAS Statement

At the end of the tax period, Vinsight has a simple WET Tax Assessment form that shows you how much WET you have to pay and tells you the amounts you have to put on to your Business Activity Statement.

Another great feature is that by clicking the “show detail” link, all of the logic and calculations are explained in full. So if one of your customers, who you thought should be a wholesale customer, shows up under retail, then you can find out why (maybe you are missing their ABN number) and you can fix it and recheck your assessment.

Finally if you use Xero, then you can post the value of the assessment to Xero, and file your BAS.